income tax calculator philippines

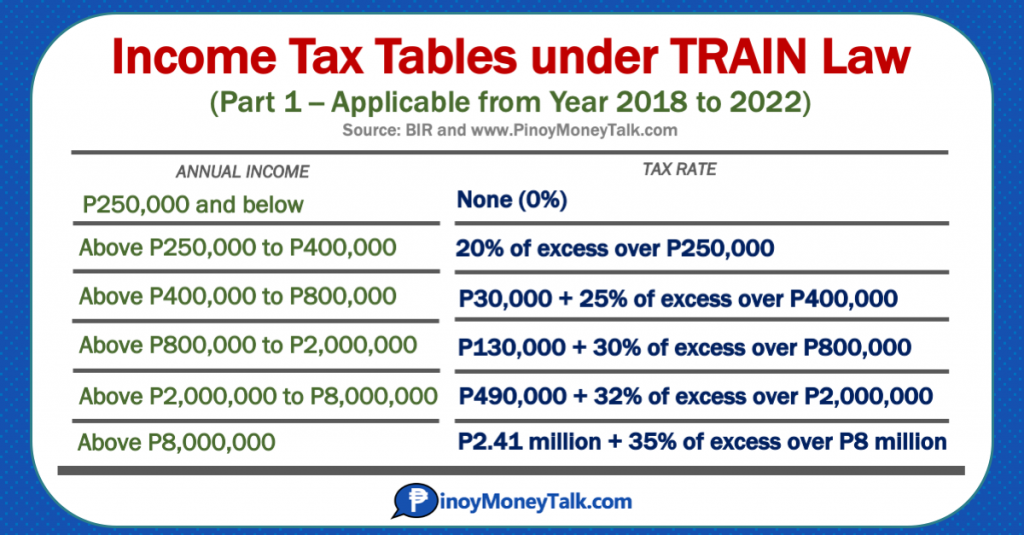

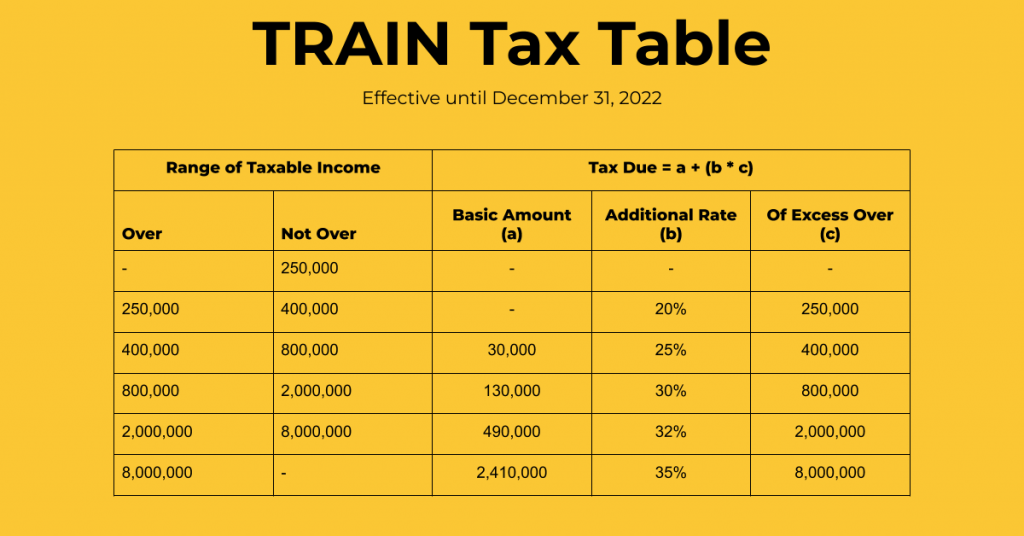

Before the enactment of this new law an individual employee or self-employed taxpayer would normally have to file an income tax at the rates of 5 to 32 depending on ones bracket. No validation process is being performed on the.

How To Calculate Foreigner S Income Tax In China China Admissions

The calculator is designed to be used online with mobile desktop and tablet devices.

. The calculator is designed to be used online with mobile desktop and tablet devices. It is an ideal choice for small-scale. Philippine Public Finance and Related Statistics 2020.

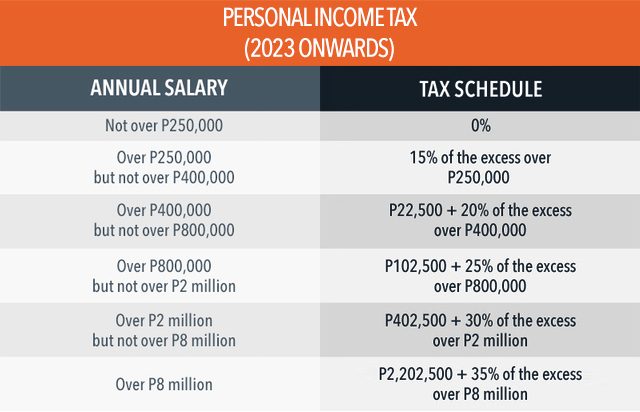

That means that your net pay will be 12034 per year or 1003 per month. The Tax tables below include the tax rates thresholds and allowances included in the Philippines Tax Calculator 2023. Taxumo is the best option for digital tax filing in the Philippines.

Income tax rates vary depending on an individuals taxable income but in general residents of the Philippines must pay taxes on their worldwide income at a rate of 30. If you make 14950 a year living in Philippines you will be taxed 2916. Philippines Monthly Salary After Tax Calculator 2022.

Philippines Annual Salary After Tax Calculator 2022. What is the average salary in Philippines. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8 na buwis sa lahat ng kabayarang siningil ng propsesyunal sa halip na magbayad ng personal income.

So if you are earning the minimum wage of Php 15000 you can have an additional take-home pay of Php 154183 per month under the 2018 tax reform. Philippines Residents Income Tax Tables in 2023. Income Tax Calculator Philippines Who are required to file income tax returns.

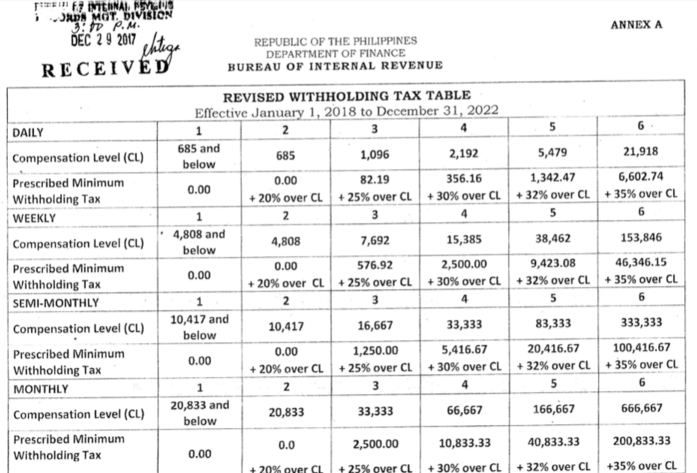

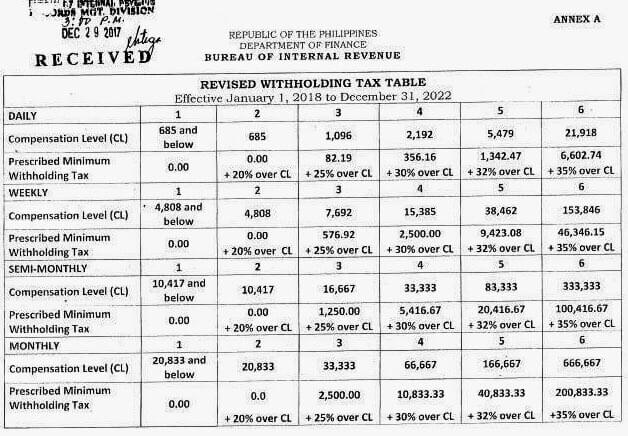

Code to add this calci to your website. Tax computation in the Philippines changed this January 2018 in the form of the Tax Reform Bill of the Duterte Administration. Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens receiving income from sources within and outside Philippines fall under income tax category use this online calculator to calculate your taxable income.

Accordingly the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers. It is the 1 online tax calculator in the Philippines. Follow these simple steps to calculate your salary after tax in Philippines using the Philippines Salary Calculator 2022 which is updated with the 202223 tax tables.

Enter Your Salary and the Philippines Salary Calculator will automatically produce a salary after tax illustration for you simple. Your average tax rate is 195 and your marginal tax rate is 40. This marginal tax rate means that your immediate additional income will.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income. There are now different online tax calculators in the Philippines. Should be paid a night shift differential of not less than ten percent 10 of his regular wage.

Select Advanced and enter your age to. Good thing that there are online tax calculators available in the Philippines to make everything easier for you. In addition Philippine residents who are working abroad and earning a salary or wages may be subject to social security contributions and other withholding taxes.

Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive income interests dividends royalties and. Under Philippine labor laws an employee who works between 10 pm to 600 am. Review the latest income tax rates thresholds and personal allowances in Philippines which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Philippines.

The Monthly Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor. Income Tax Rates and Thresholds Annual Tax Rate.

Philippines Income Tax Calculator. You must always be sure to go with the best efficient updated and legitimate online tax calculator program. The current tax table is relatively simpler and allows employees to take.

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. Compute for the Income Tax. One of the reasons is the night shift differential pay.

Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive income interests dividends royalties and prizes. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Choose a specific income tax year to see the Philippines income tax rates and personal allowances used in the associated income tax.

Remember that there are different tax bands based on your total income so you may.

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Tax Calculator Compute Your New Income Tax

How To Create An Income Tax Calculator In Excel Youtube

Income Tax Calculation Formula With If Statement In Excel

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Bir Tax Calculator Shop 50 Off Www Ingeniovirtual Com

Bir Tax Calculator Shop 50 Off Www Ingeniovirtual Com

Bir Tax Calculator Shop 50 Off Www Ingeniovirtual Com

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021

How To Calculate Income Tax In Excel

Tax Calculator Compute Your New Income Tax

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

How To Compute Your Income Tax Using Online Tax Calculator An Ultimate Guide Filipiknow

2022 Bir Train Withholding Tax Calculator Calculator

Provision For Income Tax Definition Formula Calculation Examples